15 Dec 20

“It is during our darkest moments that we must focus to see the light.”

“It is during our darkest moments that we must focus to see the light.”

Given the past 12 months, if I could ask that we all for the love of God focus together, that would be great!!

There is little one can say to try and sum up the happenings of the past year, let alone that of the past 4 years. Just when we thought that there could be nothing worse than the antics of Brexit (which by the way are now at a crunch – in case you missed it), we are given the joys of Covid-19.

Without wanting to make jest out of what has been the biggest health crisis in entire generations - is it ok to say……. “for the love of God, someone please make it stop”!

Thankfully, we seem to be reaching the light on both fronts and I am not sure that the globe, in general, is quite ready for any more surprises, I think we have had our fair share of these.

For several years since 2016 and since the emergence of Brexit we have kept a watchful eye on the property market (as we do) and analysed, as best we can, the impact of Brexit talks and negotiations on our property values and the confidence in general terms for our economy.

Given the calamities we have witnessed globally, at a political level (and for the record I miss The Donald), an economic level (and we ain’t seen the beginning of this in Europe in light of Covid), not to mention the mess we find ourselves in from a socio-economic perspective, you would not be blamed for just battening down the hatches, possibly buying a fishing boat and calling it a day…… but as a client of ours put it recently:

“where the world is in crisis, the Rock excels”.

A bullish comment, but so accurate when it comes to the experience, we have had over the past 4 years and ironically enough over the past 10 months since March 2020. There is no question (and regardless of my banter), that we are and have been so incredibly fortunate, but to a larger degree so well placed and structured to have (in the main) done so well – and I am of course primarily referring to the property sector.

Against all the odds, we have seen price increases and sales volumes take a sharp rise throughout 2020 and as mentioned on so many occasions in previous updates, it has been the owner occupier markets, largely two-, three- and four-bedroom properties in mid to high end developments showing some truly spectacular gains with some increases in excess of 10%. The higher end and fourth tier in the market generally with price ranges upwards of £1,500,000 has also re-emerged with strong activity in this sector and sales in areas such as The Sanctuary (circa £6m), Buena Vista Park (average of £2.2m), Admirals Place and other.

Interestingly we have also been party to the sale of a twobedroom apartment at Ragged Staff Wharf at £815,000 and four bedrooms in Quay 29 / 31 at upwards of £1m and delivering rates per sqm reaching £7,000 and beyond.

Without insight into circumstances surrounding us and an understanding of the dynamics of Gibraltar, the numbers are non-sensical and you may choose to take the view that this estate agent is quite frankly taking you for a ride….:)

Our view of the why’s and the how’s is best described in the extract below which we wrote some time ago:

WHY THE CONFIDENCE?

Whereas one couldn´t have been blamed for being cautious with any expectations (and still can´t), there seemed to be a driving force of interest and investment in Gibraltar, underpinned primarily by our Finance Centre, our strength in regulating our financial services and importantly, the fact that we speak English and are subject to British Law. I have referred to these attributes on many occasions in the past, and I will not tire in re-stating that the value of these factors is huge and will, in our view, continue to be the firm basis of our success in the future.

Our views over the years maintain a trend: growth in owner occupier driven markets steered by a continuously growing gaming and finance centre, with stability and security adding further value.

Whereas we have been pleasantly surprised with the growth in a large part of the property sector, we also continue to remain cautious and to a large degree negative on the studio market sector.

We took a view to stay out of this segment several years ago due to the high volume of proposed developments exclusively aimed at this product. We struggled with the prices being pitched and the marriage to an identifiable end user. It appears that to date it is the only sector that in general terms has not enjoyed the growth in capital appreciation attained by much of the market.

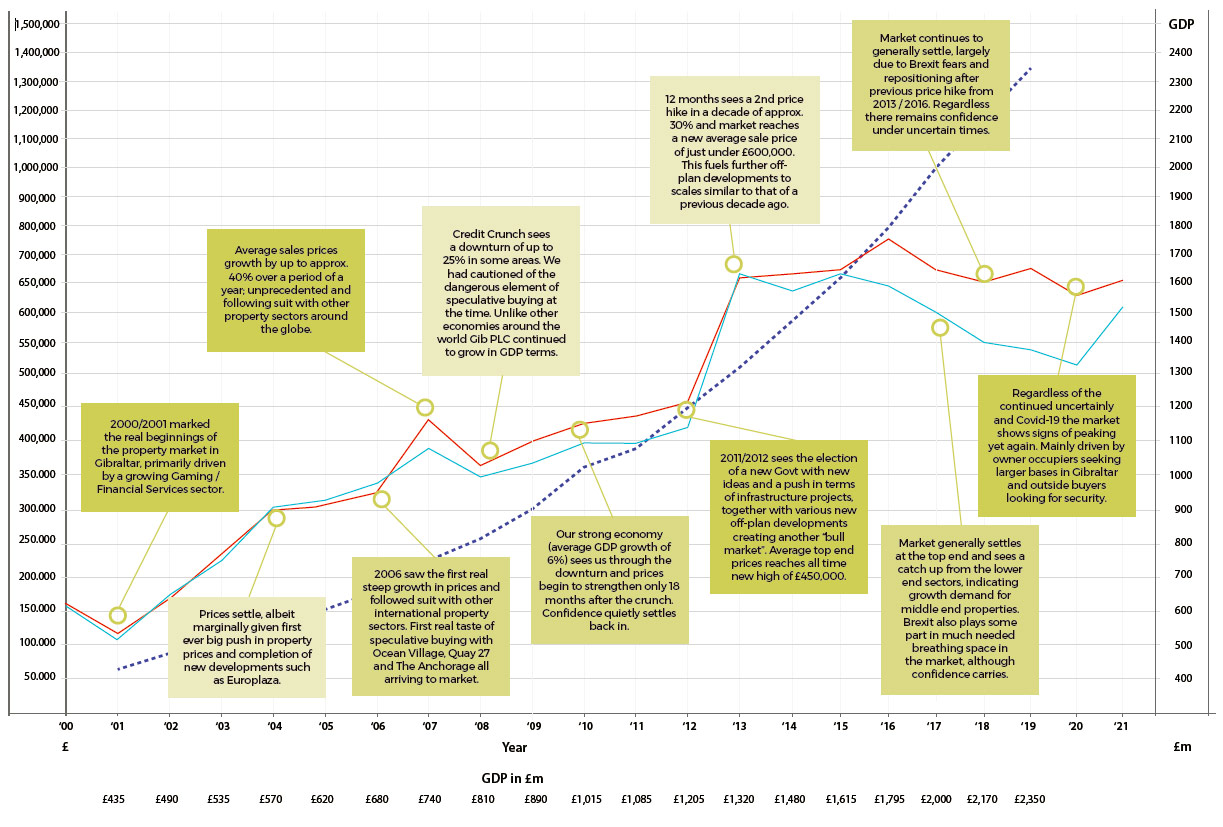

The data set out in the below graphic are based solely on BMI’s own sales and are, therefore, to be treated as only indicative of trends in the wider Gibraltar market. The GDP stats have no correlation to market prices and is merely shown to highlight the growth in our economy.

We hope that with this recent write up we can give a small and educated snapshot of the market where we see the upsides, as well as the downsides. The market and the economy remain difficult to forecast, but if the year gone by (2020) and the time since the Brexit referendum is anything to go by, we have done swimmingly and held our own immensely well. 2021 will no doubt bring its challenges, but we hope that our ability to overcome this truly exceptional year will stand us in good stead to continue with our ever-growing economy and with it our property sector too.

As I write this, we have just closed a sale that has reached the £7,000/sqm mark, we have achieved this level on more than several occasions now, we have indeed reached a new level that we believe is here to stay. As a great man once said – “it always seems impossible until it’s done”